As the 18-24 bracket, we are taken to be easily swayed by pop culture, trends, and peers. Politicians don’t expect us to be educated, no less financially savvy. As Ravens, let us collectively throw Washington for the loop. While it is evermore important for us to stay learned in the social affairs of America, our taxes could be in jeopardy in 2025. The Tax Cuts and Jobs Act (TCJA) of 2017 is due to expire in 2024.

Dave Ramsey, a well known financial adviser, interviewed president-elect Donald Trump about his view ofAmerica’s financial disaster. This interview is a helpful tool to gain insight on the 2017 Tax Cuts and Jobs Act,how it influenced America up to now, and the improvements that can be made in the wake of its expiration.

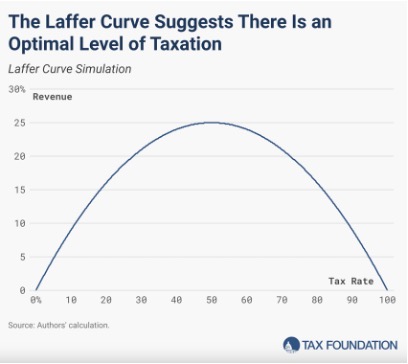

In the interview, Dave Ramsey touched upon a tax concept theory known as the Laffer Curve. Through the Trump-instituted TCJA system, the Laffer Curve proved to be beneficial. First, by lowering taxes, small businesses were shown to hire more staff rather than pocket the itemized deductions. The Laffer Curve displayed that this step heated up the economy, bringing in more money to the Federal Government than ever before.

“Almost 60% of people in the U.S. work for small businesses.Politicians aren’t the ones creating the jobs,” said Ramsey.

To put it very simply, when people are employed, theywill spend more and cause customers to do the same;‘heating up the economy.’

Currently, under the TCJA, taxes are at 22% for households making 60-100K yearly, and 21% on corporations. Trump can be thanked for getting the corporation tax rate downfrom almost 50%, if you factor in state and local income tax, to the number it is at now. When asked what he plans to do once TCJA expires, if he ends up sitting in office, he explained “…21% to 15%, but you have to manufacture your product here. Then, I’m going to put tariffs on countries [foreign imports] so our industries can be competitive.”

Trump stands warmly with the idea of tariffs. Recalling the time of President William Mckinley, known as the“Napolean of Protection”, Trump expressed belief in Mckinely’s idea of tariffs being a form of protection of America. Protecting our industries and goods from other countries and making our imports more expensive.

One might recall the situation with the steel industry during Trump’s last term.

“I saved our steel industry by putting tariffs on steel China came in and dumped… They dump and everyone goes out ofbusiness and then they buy those businesses and raise the prices higher than they ever were,” said Trump.

Dave Ramsey also reached out to Kamala Harris and her team but got no response. After a little digging, ForbesMagazine posted the Harris-Walz tax plan for public reference on the Forbes website. Columnist Milton Ezratiquotes, “[The Harris Administration] would add to the tax burden of corporations and individuals who earn morethan $400,000 a year, while offering targeted relief to many at the lower end of the income distribution.”

Read more: The Harris-Walz Campaign Reveals Its Tax Plans

Implementing these plans would evolve largely through treatments of the scheduled 2025 reconsideration ofTCJA tax reforms. If Congress does nothing, those reforms will expire next year and 62% of Americanhouseholds will see a tax hike in 2026.

While the plan aims to target lower income households for benefits, a narrow tax base— that which is non-neutral as itfavors only certain groups—is inefficient because more revenue is raised at lower rates in a broad tax base. The articlemakes a point to mention this, “Implementing these plans would evolve largely through treatments of thescheduled 2025 reconsideration of 2017’s tax reforms. If Congress does nothing, those reforms will expire next yearand 62% of American households will see a tax hike in 2026”, said Ezrati.

To further educate yourself on the Tax Cuts and Jobs Act, a helpful and non-biased source is the website Investopedia. This site reviews each sector of the Act in clear terms that are applicable to those who operate outside of the economics realm.

Read More: What Is The Tax Cuts and Jobs Act?