The Constitutional Fellows put on a panel with Tony Tanking, Dr. Anthony Crifasi, Dr. John Settich, and Dr. James Young to help educate students on the student loan debt forgiveness plan announced by President Biden on August 24. The panel took place on September 6 in the McAllister Board Room.

The panel began with 10 minute speeches from each panelist on the topic before opening the floor to questions from the students. The first panelist to speak was Tony Tanking who works in the Financial Aid office. He gave a more factual speech on what the plan is and how Benedictine College students could take advantage of it.

“The loan forgiveness is for the individual who took the loan,” Tanking said.

Loans that were taken out prior to June 30, 2022, are eligible for forgiveness. Tanking explained how a student can fill out an application for loan forgiveness sometime in early October on the website studentaid.gov.

Those who fill out an application are eligible for up to $10,000 forgiven if they make less than $125,000 per year as an individual. If the applicant is married or the head of a household, they are eligible if their earnings are less than $250,000 per year. Those who have been awarded a Pell Grant are eligible for loan forgiveness up to $20,000.

One point that Tanking made sure to get across is that the individual does not get to choose what loans get forgiven. That is left up to the Department of Education and the federal government.

The next speaker was Dr. Anthony Crifasi, who is a professor in philosophy. His speech focused on the ethics of the plan.

Crifasi talked about how this plan could be a moral dilemma based on the fact that it can become easier to justify taking out more loans if a percentage of loans you already have will be forgiven. However, Crifasi also didn’t want people not to take advantage of the opportunity.

“I want the people eligible to benefit from this loan forgiveness,” Crifasi said.

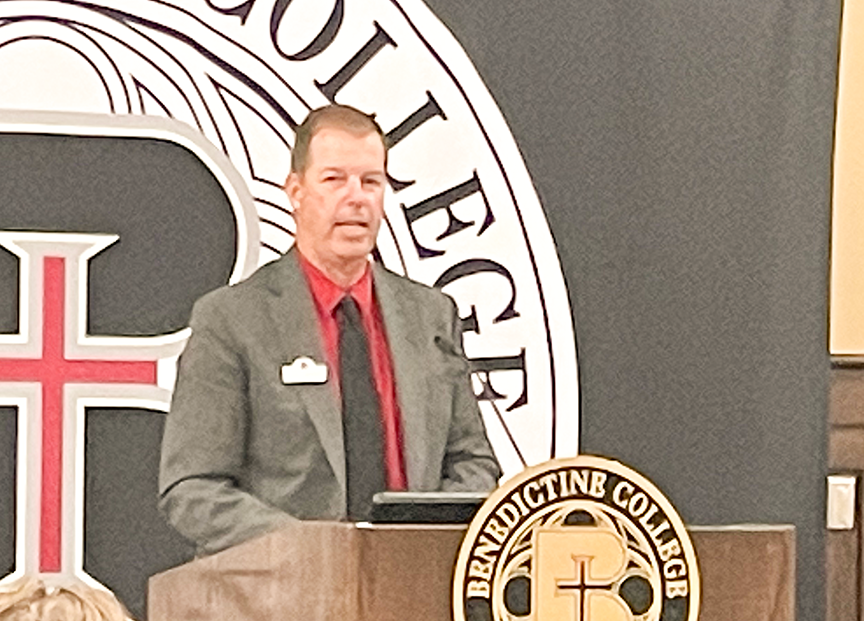

The next speaker was Dr. John Settich, a political science professor, who brought up a very important question.

“Why is college so expensive?” Settich asked.

The answer to this question has many parts. However, Settich brings a very good point in his answer.

“In my view as a policy analyst, there is one principle reason the charges are so much higher even after the costed dollar calculations,” Settich said. “Loans and scholarships and discounts have fogged the true price of college for several generations of American college students.”

A variety of different factors go into this statement. One main factor that Settich brought up was the probability that a student may not graduate in four years, or even six years. However, the student will still have thousands of dollars in student loans to pay back even if they do not graduate.

“Families choose colleges that match their preferences, and yet they should calculate the cost of student loan debt,” Settich said.

The final panelist was Dr. James Young, an economics professor.

“Let me start with just giving you the typical economic justification for government support of education, especially higher education,” Young said. “There is this idea called positive externality that for some sort of extra social benefit being made that you as a student may not think about when deciding to come to college.”

A student receives the incentive to go to college through loan support, however, many factors can come into play that turn this support into a negative thing. The first being that dropouts tend to be at a disadvantage when paying back student loans. The second is that your income after college can put you at a disadvantage when paying back student loans. The third point is that many people are concerned about possible inflation this policy might cause.

If you are interested in learning more about the student debt forgiveness plan, visit studentaid.gov or the fact sheet located on whitehouse.gov.